What is a Demat account?

Demat accounts, or dematerialised accounts, allow you to hold shares of a company electronically. A Demat account enables you to hold dematerialised securities such as stocks, mutual funds, exchange-traded funds (ETFs), bonds, etc.

When you place an order for a stock, your shares are credited to your Demat account. Similarly, your Demat account is debited whenever you sell your shares.

How to Open Demat Account?

Opening a Demat account has never been easier. Simply follow these steps to, Open a Demat account on Taurus Website

1. Visit www.taurusgrp.com website to Open a Demat Account.

2. Click on Online Account -> New Account Enter your Name as per PAN, Date of Birth, PAN Number, Email Address and Mobile number and click on “Proceed.”

3. You will receive a verification code on the same number and email id. Insert the code & click on the “Apply Now” button.

4. Complete the E-KYC (Know Your Customer) process

7. Complete the Verification Procedure. This will require you to upload a selfie in real time.

8. E-sign the form to complete your account opening procedure.

9. All investors are requested to take note that 6 KYC attributes i.e., Name, PAN, Address, Mobile Number, Email id and Income Range have been made mandatory. Investors availing custodian services will be additionally required to update the custodian details.

Documents Required for Demat Account

1. Proof of identity: Voter’s ID, Aadhaar card, PAN card, passport, or driving licence

2. Proof of Address: Ration card, electricity bills, telephone bills, property tax receipts, passport, bank passbook, voter’s ID, or Aadhaar card

3. Proof of Income: Photocopy of the Income Tax Return (ITR), recent salary slip, bank A/C statement of the current bank,

4. Proof of Bank: cancelled personalised cheque.

Factors to consider for Opening Demat Account

1. Ease of Opening an Account

SEBI mandates a complete process for service providers to follow when creating a Demat account. However, they can simplify some aspects of the steps to open a Demat account.

For example, using your Aadhaar number, you can open a Demat account through the e-KYC process. Through e-KYC, clients only need to provide a final self-identification through a video camera or a selfie. A physical account opening takes approximately five days, whereas e-KYC takes less than two days.

2. User-Interface

Most brokers have their own software that you can install. You can find out which app has the best interface by performing some research or reading reviews. It is also possible to download different mobile apps from different DPs and choose the one that works best for you. An account with an intuitive interface that does not lag can be helpful and convenient.

3. Account opening charges

There are various charges associated with Demat accounts, including Annual Maintenance Charges (AMC), charges for physical and duplicate statements, and costs associated with dematerialization and rematerialization. It is, therefore, crucial to confirm the DP’s costs to ensure that they are fair and in line with industry standards.

To get a better idea of how the DP stands, you could compare the costs with those of other similar service providers. Although cost savings are important, they shouldn’t always take precedence. It is also important that the DP provides you with high-quality service.

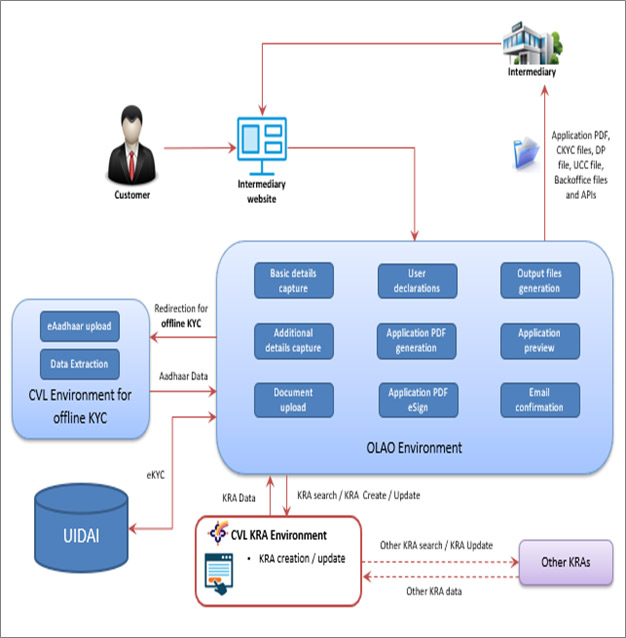

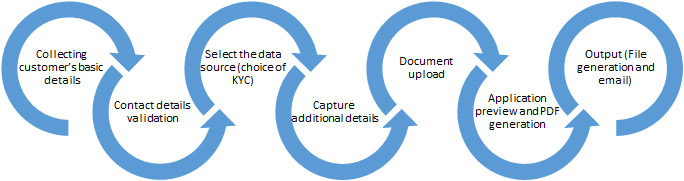

Process Flow

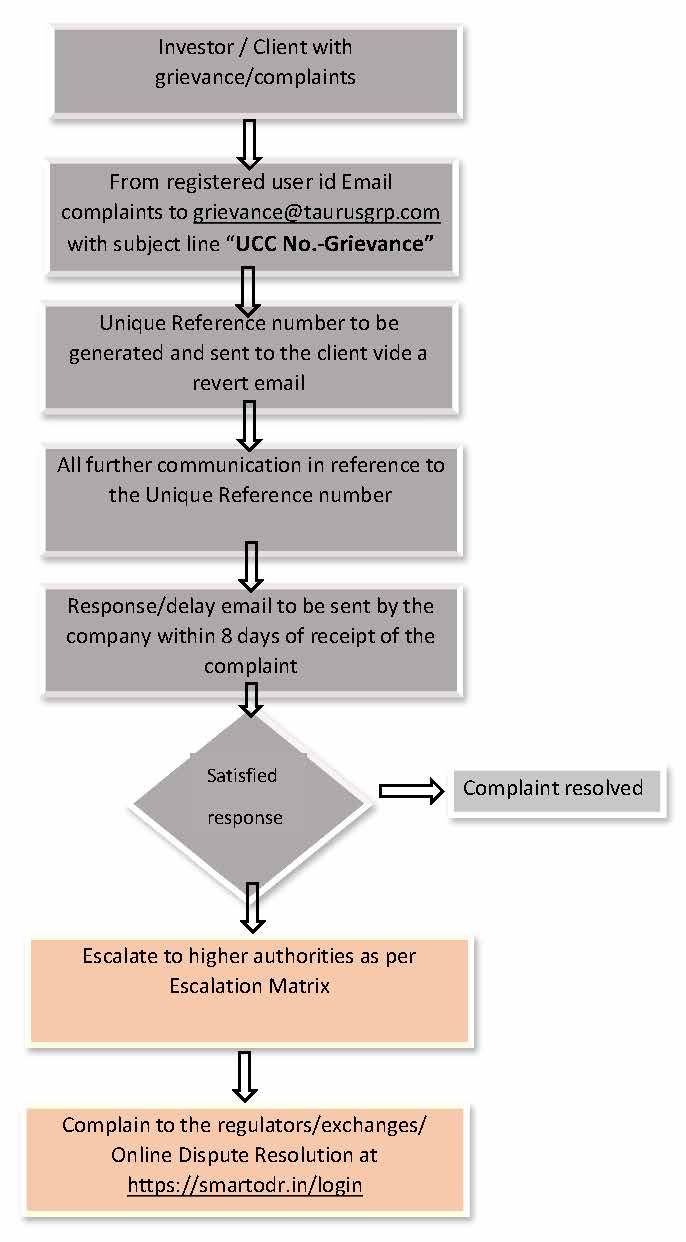

Procedure for filing a complaint

Any investor/client who wants to lodge grievance with the company may do so by following the below mentioned steps:

- Send an email from your registered email id to the company’s compliance/grievance department at grievance@taurusgrp.com, under the subject line “UCC No. – Grievance”

- Upon receipt of the email by the concerned department a unique reference number will be sent by a revert email, acknowledging the receipt of the grievance. You may refer to this reference number for all further correspondence regarding the status of the grievance

- Any grievance would ideally be solved within eight working days from the receipt of the same on the company’s’ grievance id and a response(resolution/delay) will be sent to the client within the said period.

- If the investor/client is not satisfied with the resolution offered by the company, he may escalate the matter to the higher authorities as per the Escalation matrix

- If not satisfied with the end response from the company, you may file grievances with the Exchanges/regulator on

- Pursuant to the SEBI Circular SEBI/HO/OIAE/OIAE_IAD-1/P/CIR/2023/131 dated July 31, 2023, the new SMART ODR Portal (Securities Market Approach for Resolution Through ODR Portal) is now live. This platform is designed to enhance investor grievance redressal by enabling investors to access Online Dispute Resolution Institutions for the resolution of their complaints.

The SMART ODR Portal has been jointly setup by the Market Infrastructure Institutions (MII’s) together with the participation of reputed ODR Institutions.

|

Details of |

Contact Person |

Address |

Contact No. |

Email Id |

|

Customer Care |

Ms. Chinmayee Jadhav |

203, Cosmos Court, S.V.Road, Vile Parle (West). Mumbai – 400056. |

022-61471166 |

|

|

Head of Customer Care |

Mr. Ashok Kumar Bajaj |

022-61471192 |

||

|

Compliance Officer – Exchanges |

Ms. Deepali Vartak |

022-61471177 |

||

|

Compliance Officer – CDSL |

Ms. Heena Gandhi |

022-61471144 |

||

|

CEO |

Mr. Amar Gandhi |

022-26104922 |

|

Sr. No. |

Regulator |

Weblink |

|

01 |

NSE |

|

|

|

BSE |

|

|

|

MCX |

|

|

|

CDSL |

|

|

|

SEBI |

You may access the portal at https://smartodr.in/login or seek help from the team by sending email to help@smartodr.in or contact on the helpline number +91-8105148710.

* You may further refer to the Investor Grievance Mechanism for detailed information

List Of Authorised Persons (AP)

|

Sr. No. |

Authorised Person’s Name |

Authorised Person’s Code |

Constitution |

Status |

Registered Address |

Terminal Details |

||||

|

(Approved / Cancelled) |

Add |

City |

State |

Pin code |

Terminal Alloted(Y/N) |

No. of Terminals |

||||

|

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

List of Authorised Persons (AP) Cancelled by Members on Account of Disciplinary Reasons |

||||

|

Sr. No. |

Authorised Person’s Name |

Status |

Authorised Person |

|

|

Date |

Reason |

|||

|

0 |

0 |

0 |

0 |

0 |